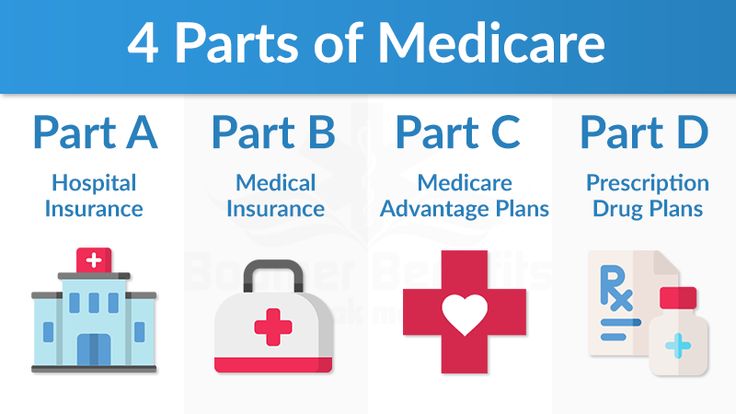

If you’re beginning your Medicare journey, knowing the 4 parts of Medicare is critical. Just about everything you’re going to read and watch is going to reference them. Eventually, you’re going to have to enroll in Part A and Part B. And, depending on your Part C selection, you may need separate Part D coverage.

Have I confused you enough? If so, hang in there. Let’s begin with the basics and see what the 4 parts of Medicare cover.

Medicare Part A

Part A covers some of your costs when you’re in the hospital. You don’t pay for Part A unless you’ve worked for less than 10 years in the U.S. during your lifetime. Some of the services Part A covers are:

- Inpatient hospital care:

- Home health care

- hospice care

- skilled nursing care

Medicare Part B

Part B covers outpatient care, like your doctor’s office visits, It also covers:

- Preventative services

- Physical, speech, and occupational therapy

- Mental health services

- ambulance services

- durable medical equipment (wheelchairs, canes, walkers, etc.)

You don’t have to enroll in Part B if you decide to continue coverage with an employer’s group health insurance plan. You’ll need to enroll in Part B within 60 days after leaving that coverage.

Medicare Part C

Part C, also known as the Advantage Plan, is optional. If you choose it, you’re replacing Parts A and B, also known as Original Medicare, provided by Medicare with coverage through a private insurance company. Most Advantage Plans cost less than Original Medicare and include all of the benefits of Plans A and B, and sometimes Part D.

Part D

Part D is an optional prescription drug plan. If you choose an Advantage Plan, you probably won’t need it. If you go with Parts A and B from Medicare, you’ll want to enroll in Part D with a private insurance company. You can’t by Part D by itself, you either must have Original Medicare or an Advantage Plan.

A Medicare supplement insurance policy, also called Medigap, is optional coverage you can and should buy if you have Original Medicare. Medigap plans pay for just about everything Medicare Parts A and B don’t pay for completely.

For example, if your doctor charges you $100 for an office visit, Medicare Part B will pay 80% of the charge ($80) and your Medigap policy will cover the other 20% ($20). Without the Medigap policy, you’d have to pay the $20 out of your own pocket.

That may not seem like much, but 20% of a $100,000 hospital bill would cost you $20,000 out-of-pocket, which your Medigap plan would have paid for you.

As I’ve mentioned, I don’t sell Medigap insurance, or any other type of insurance. You can buy a Medigap policy from a licensed insurance agent. Ideally, one who specializes in Medicare and represents more than one company for you to choose from.

Understand the 4 parts of Medicare?

If not, there are a couple of ways to get more information.

First, I have more detailed information about each part on this website.

Second, you can go to Medicare.gov and get information from the official site.

Ideally, you’ll do both so you can see the information a couple of times and not miss anything important when you choose or use your Medicare coverage.