Before I give you four steps to buy a Medicare supplement insurance policy (also called a Medigap plan), let me give you three reasons why I’m qualified to give you advice about Medicare supplements:

- I turned 65 two months ago, researched, and bought a Medicare supplement the month before

- I sold Medicare supplements for a very large, well-known insurance company

- I research and write about Medicare almost every day

So, read on and follow these steps to make buying a Medicare supplement a less stressful experience.

Step 1: Know what type of coverage you need from a Medicare supplement and then choose your Plan.

Every Medicare supplement of the same type has the same benefits, regardless of the company selling the supplement.

For example, Medicare supplement (Medigap) Plan G has the same coverage whether you buy it from Insurance Company X or Insurance Company Y.

But, Plan G doesn’t have the exact same benefits as Plan F. The difference being that Plan F pays your Medicare Part B deductible for you, but Plan G doesn’t (of course, Plan F costs more).

You need to know if that’s important for you or not. And, the only way you can tell that is by knowing all about the different plans.

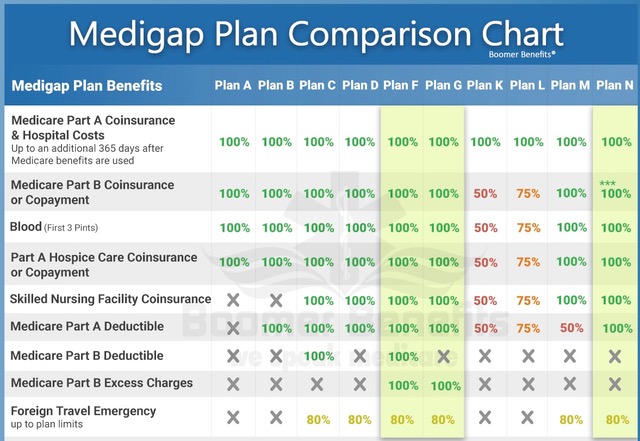

This chart will help:

Chart courtesy of Boomer Benefits (they sell Medigap policies)

You should have this chart in front of you when you’re making your final decision about which Plan to buy.

Step 2: Find out which insurance companies are approved to sell Medigap plans in your state.

Not all insurers are approved to sell Medicare supplements in every state.

For example, you may have a life insurance policy with Company A, but they may not be approved to sell Medicare supplements in your state.

You can find out which companies are approved in your state by contacting your state’s Insurance Commissioner’s office or website.

And, speaking of different companies, remember that insurance companies have different prices for the same plans.

For example, Plan A may cost less from Insurer X compared to Insurer Y.

Step 3: Research the insurance company and the agent you choose to do business with.

When you buy a Medicare supplement, you’re making a very important financial decision.

For example, your financial future might depend on your insurer paying the balance of a very large hospital bill not paid for completely by Original Medicare Plan A, leaving you with thousands of dollars of out-of-pocket costs.

While you’re checking out the number of complaints against the insurance company you’re leaning towards providing your Medigap plan, check out the agent too. Make sure they are licensed to sell insurance in your state and find out if there have been any complaints filed against them.

Unfortunately, there are many unscrupulous agents selling Medicare supplements. They prey on seniors who don’t understand what’s covered and what’s not, and sometimes will sell them the wrong plan or a plan they don’t even need.

To further protect yourself, get quotes from three agents before you buy a policy. They may sell the same Plans from the same companies, but talking with three agents lets you pick the agent you’re comfortable with and trust the most.

Don’t do business with this guy:

Step 4: Buy the Medicare supplement insurance policy.

It’s been said that “Indecision is the thief of opportunity.” The amount of stress there is when you buy a Medicare supplement can lead to indecision. Don’t let that happen to you.

After completing the first three steps I’ve given you, you’ll be ready to choose a plan, complete the paperwork, and write a check for the first three month’s premium (after the initial payment of three months you can pay monthly).

And remember, never make the check payable to the agent selling you the supplement or give them a cash payment. All checks should be payable to the insurance company.

Let Medicare For Boomers know if you have any questions.