Medicare Part A

Understanding Medicare Part A

Medicare, the U.S. federal health insurance program, primarily serves individuals over 65, along with some younger people with disability status as determined by the Social Security Administration. Medicare Part A, often referred to as hospital insurance, plays a crucial role in the healthcare coverage of millions of Americans.

Coverage Under Medicare Part A

- Hospital Care: The core of Part A coverage. It includes inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Skilled Nursing Facility (SNF) Care: This is provided after a hospital stay and covers a semi-private room, meals, skilled nursing and rehabilitative services, and other services and supplies.

- Hospice Care: For patients who are terminally ill. This includes support for pain relief, symptom management, and emotional and spiritual support.

- Home Health Services: Includes part-time or intermittent skilled nursing care, and physical therapy, speech-language pathology services, and continued occupational services.

What Medicare Part A Does Not Cover

- Long-term Care: If the only care needed is custodial (bathing, dressing, using the bathroom), it’s not covered by Part A.

- Most Medical Services: Part A doesn’t cover doctor services while you’re hospitalized. That’s covered under Medicare Part B.

- Private Room: Unless medically necessary, private rooms aren’t covered.

- Private Nursing: Private-duty nursing isn’t covered under Part A.

- Deductibles and Coinsurance: While Part A covers much of the hospital and nursing facility charges, beneficiaries are still responsible for deductibles and coinsurance.

Eligibility and Enrollment

- Age-Based Eligibility: Most people are eligible at age 65.

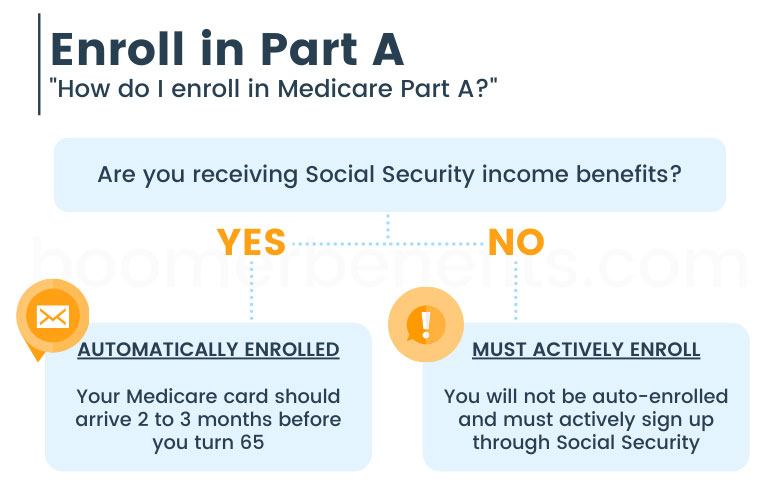

- Automatic Enrollment: Individuals who are already receiving Social Security benefits may be automatically enrolled.

- Manual Enrollment: Those not automatically enrolled must sign up during their Initial Enrollment Period.

How Much Does Medicare Part A Cost?

When Do You Enroll in Medicare Part A?

If you have to pay for Part A because you haven’t worked 40 quarters and you don’t buy it when you’re first eligible, your monthly premium will increase by 10% for twice the number of years you didn’t sign up.

What is Your Cost-sharing Under Part A?

When you use your Part A benefits in 2024, you’ll pay:

A $1,632 deductible for each inpatient hospital stay when you haven’t been hospitalized during the previous 60 days

$408 per day for days 61-90 of a consecutive hospital stay

$816 per day for days 91-150 of a consecutive hospital stay

As you can see, these charges can add up to a substantial amount of money for any length hospital stay. For this reason, having a Medicare supplement plan is advisable.

Questions? Submit your question on our Contact page.