I was concerned about Medicare and pre-existing conditions before I enrolled because I have several that make it impossible for me to buy individual health insurance from a private insurer. Fortunately, I was on my wife’s group health plan before I became eligible for Medicare in October 2022.

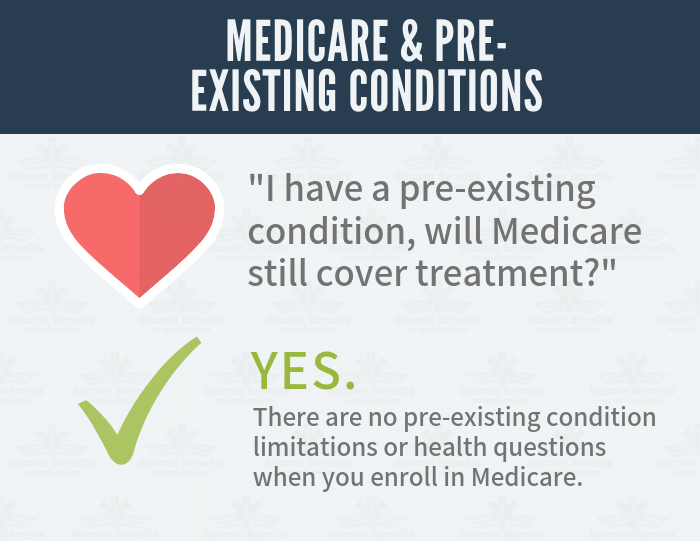

The good news is that Medicare does cover all pre-existing conditions. When you enroll in Medicare, there are no pre-existing condition exclusions or health questions asked on the forms you complete.

You can also sign up for a Medicare supplement (Medigap) during your open enrollment window without worrying that your supplement won’t cover pre-existing conditions. It will.

Medicare and Pre-Existing Conditions: What’s Covered?

For example, if you have a stroke after you enroll in Medicare and are hospitalized, Part A will cover your inpatient costs even if the stroke was caused by a pre-existing condition, like high blood pressure.

Part B will cover any outpatient needs related to your pre-existing condition. For example, if you were diagnosed with diabetes before you enrolled in Medicare and have see your doctor after your Medicare coverage became effective, those visits will be covered by Part B.

You can also enroll in a Part D drug plan during your initial enrollment that will cover the medications you’re taking.

Pre-Existing Conditions When Switching Medigap Plans

Unfortunately, yes. Most states require you to answer some health questions and go through medical underwriting when you switch Medigap carriers.

Based on your answers, they can charge you extra premiums because of pre-existing medical conditions, or they can decline to cover you at all. Each company has different requirements for approval.

A qualified, experienced Medicare supplement insurance broker may be able to help you apply with several companies and increase your chances of being approved.