Medicare Part B

Many people think of Medicare Part B as only covering doctor’s office visits, but it actually covers things both in and out of the hospital. Think of Part B coverage as any care administered by physicians.

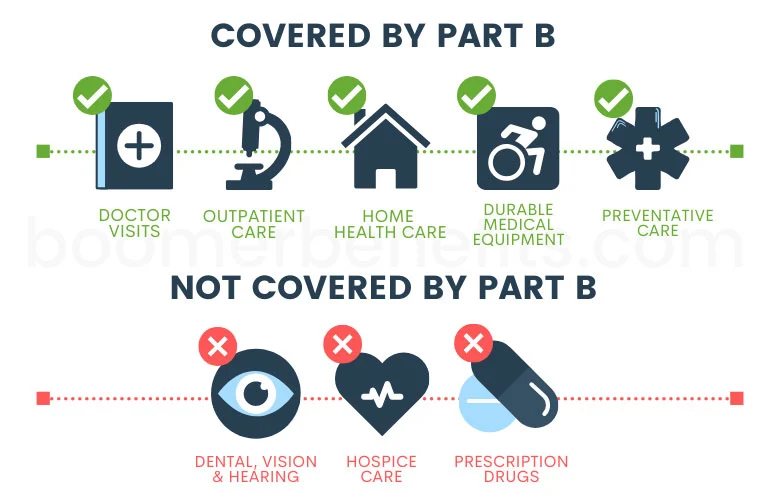

What Does Medicare Part B Cover?

Medicare Part B coverage provides you access to a variety of outpatient medical services. Part B covers preventive care including:

- flu shots

- colonoscopies

- mammograms

- and more.

It covers ordinary outpatient things like doctor’s visits, lab testing, home health care, ambulance rides, and some chiropractic care too.

However, Medicare Part B also covers services that sometimes occur in the hospital.

This includes things like physician’s services, radiation or chemotherapy for cancer, surgeries, diagnostic imaging, medical equipment, and even dialysis for failing kidneys.

Part B will also pay for drugs administered in a clinical setting, such as osteoporosis injections, infused drugs, antigens, and insulin that is used with an insulin pump.

Otherwise, the costs for your hospital room and some other inpatient services are covered by Medicare Part A, and outpatient drugs fall under Part D.

Part B is optional, but if Medicare is your primary coverage, you definitely need it. You also cannot get Medigap supplemental coverage without it.

What does Medicare cover in terms of costs under Part B?

80% of approved costs after you first pay the annual deductible, which is $226 in 2023.

How Much Will I Pay for Medicare Part B?

You must pay a monthly premium for your Medicare Part B benefits. The majority of Americans will pay the standard monthly amount set by the government. In 2023, the base rate for Part B is $164.90/month for people new to Medicare. However, you may owe more if your income is above a certain level.

If you enroll late into Part B, you may also have to pay a penalty for life. It’s important not to miss your enrollment window whenever you retire and lose access to your employer group health insurance.

Medicare will deduct your Part B premiums out of your Social Security check if you are already enrolled in your SS income benefits. If not, they will bill you quarterly. There is a credit card option at the bottom of the quarterly invoices. To pay for Part B by credit card, just complete the bottom portion of the payment coupon and mail it into the Medicare Premium Collection Center.

You also have the option to use Medicare Easy Pay, a free auto-draft service that will deduct your premium payments monthly from a checking or savings account.

How Do I Sign Up for Medicare Part B?

People who are already receiving Social Security income benefits at age 65 do not need to enroll. The Social Security office will automatically enroll you. Your card will arrive in the mail 1 – 2 months before your 65th birthday.

Everyone else needs to apply for Medicare Part B themselves at age 65. Applying for Medicare Part B can be done online, over the phone, or in person at your local Social Security office. After you apply, it will take 2 – 3 weeks before your card will arrive, so you should plan to apply several weeks prior to when you will need the coverage.

As you can see, it’s easy to sign up for Part B. It’s important to enroll in Part B during your Initial Enrollment Period unless you have other creditable coverage. Otherwise, you would be subject to a penalty.

What Doesn’t Part B Cover?

Part B does not cover hospital expenses covered by Part A. It also does not cover cosmetic procedures, routine dental, vision or hearing, or routine foot care. It also does not cover drugs that you pick up yourself at a retail pharmacy. For those, you will need a Part D drug plan.

In general, Part B doesn’t cover things that are not reasonable and necessary. Your doctor usually will know the rules for what is covered and what isn’t.

What is my Cost Sharing Under Medicare Part B?

You will pay a percentage of the costs of your medically necessary Part B services. Generally, these costs are:

- the annual Part B deductible ($226 in 2023)

- 20% of the remaining costs, with no limits or cap

- any excess charges that a provider or facility may charge beyond what Medicare reimburses

What is most significant is the 20% that you will owe for outpatient medical care. For services like surgeries or chemotherapy, your expenses can add up to thousands of dollars. There is no reason for you to be subject to these expenses when there are supplemental coverage options available for any budget.

What is the Medicare Part B Late Enrollment Penalty?

If you failed to sign up for Medicare when you were first eligible, and you didn’t have any creditable coverage, you will be subject to the Medicare Part B late enrollment penalty. This penalty is equal to 10% per year for every year (12 full months) that you waited to enroll. This penalty gets applied against the standard Part B premium, which in 2023 will be $164.90.

When you do finally enroll, you’ll need to wait for the Medicare General Enrollment Period to sign up for Part B. This period runs from January 1st to March 31st each year. Your benefits will then begin the 1st of the following month after you apply. This can be a double whammy because not only do you now owe a penalty, but you have to wait several months for your coverage to kick in.

If you enrolled late because you’ve had employer group health coverage from a company with 20 or more employees, you will not be subject to the Part B late enrollment penalty. When you leave that coverage, you have 8 months to sign up for Part B. This is your Special Enrollment Period for Medicare.

The best way to avoid the Medicare Part B late enrollment penalty is to enroll in Medicare during your Initial Enrollment Period.

Get Help with Medicare Part B

There are two main ways in which you can protect yourself against catastrophic medical spending:

1) Medicare supplements are available for purchase to cover the parts that A & B don’t.

2) Medicare Advantage plans are an option if you are open to getting your A & B benefits through a private health insurance plan with a smaller network than Medicare.

A licensed insurance agent who specializes in Medicare and Medicare supplements can help you make the best choice between the different Medigap policies available and Medicare Advantage.