Medicare Part C

Medicare Part C, commonly known as Medicare Advantage, provides an alternative to the Original Medicare (Parts A and B). Offered by private insurance companies approved by Medicare, it’s an all-in-one plan that bundles hospital, medical, and often, prescription drug coverage.

What is Medicare Part C?

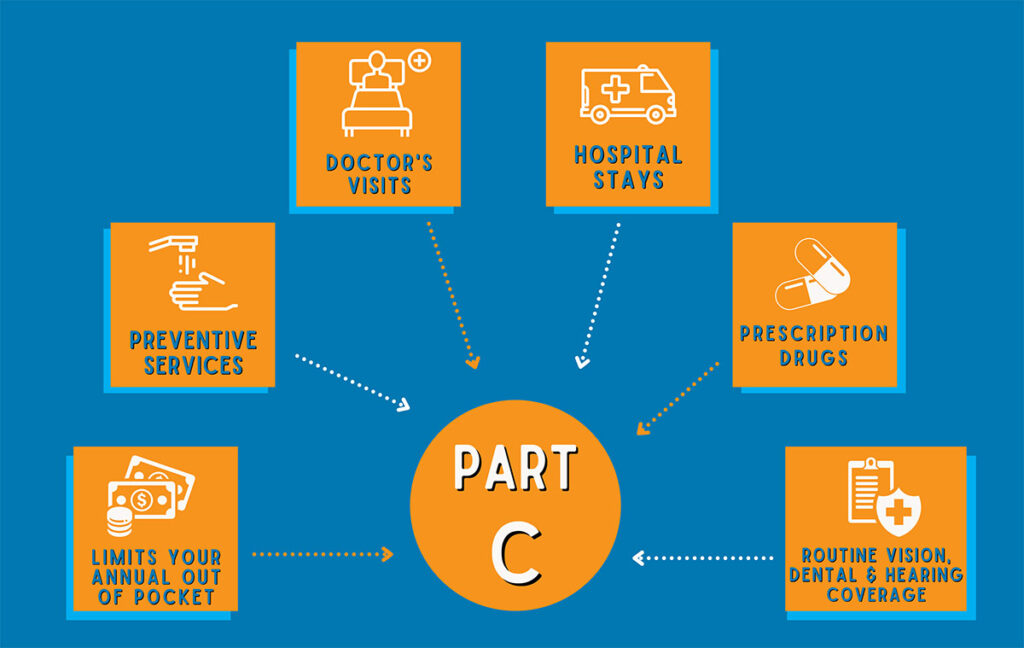

This plan combines the benefits of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance), and usually includes Part D (prescription drug coverage). It often comes with extra perks like vision, hearing, and dental coverage, which aren’t typically covered under Original Medicare.

The Cost of Medicare Part C

The costs for Medicare Part C vary depending on the plan and provider. These costs include a monthly premium (which might be $0 in some plans), deductibles, copayments, and coinsurance. It’s important to note that you still have to pay the Medicare Part B premium, in addition to any premium charged by the Medicare Advantage plan.

Traditional Medicare vs. Medicare Part C

Comparing Medicare Part C to traditional Medicare (Parts A and B) with a supplement plan (Medigap) is key. Original Medicare covers hospital and medical costs, but not everything. That’s where Medigap comes in, covering gaps like copayments, coinsurance, and deductibles. However, Medigap doesn’t include prescription drug coverage, which you have to get separately through Part D.

Medicare Part C often bundles all these aspects, potentially simplifying your coverage. The choice between traditional Medicare with a supplement plan and Medicare Advantage depends on your healthcare needs and financial preferences.

Is Medicare Part C Better Than Traditional Medicare?

The answer to whether Medicare Part C is better than traditional Medicare depends on individual circumstances. Medicare Advantage plans can offer more benefits and potentially lower out-of-pocket costs. However, they may also come with network restrictions, meaning you can only see certain doctors or go to certain hospitals.

On the other hand, Original Medicare, supplemented with a Medigap policy, offers more flexibility in choosing healthcare providers but might be more expensive in terms of premiums and doesn’t always include prescription drug coverage.

Conclusion

Choosing between Medicare Part C and traditional Medicare with a supplement plan requires considering your health needs, financial situation, and personal preferences. It’s advisable to compare different plans and consult with a healthcare advisor to make an informed decision.