What Are Medicare Supplements?

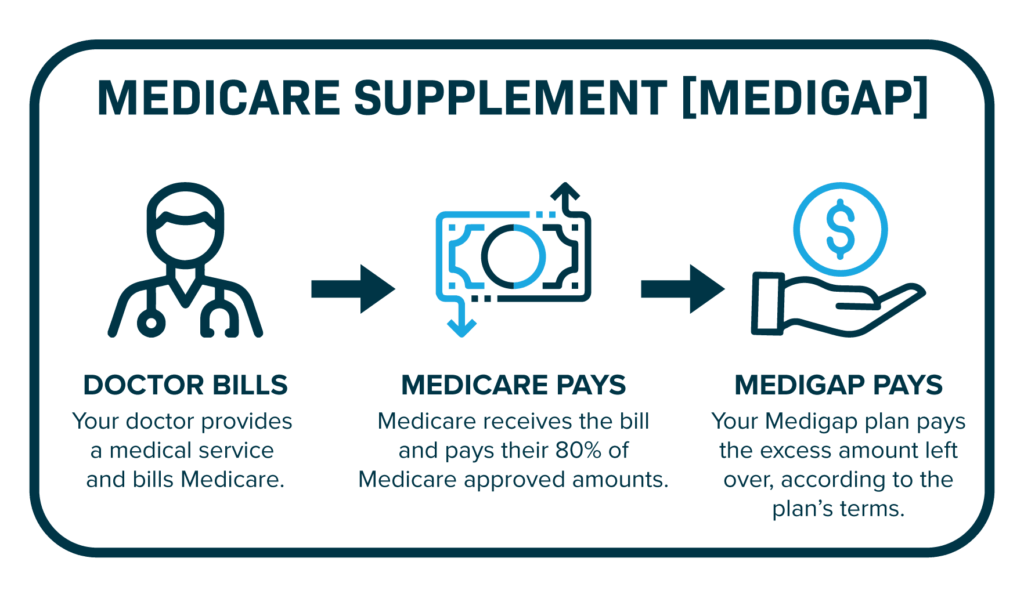

Medicare Supplements, commonly known as Medigap, are insurance policies designed to cover healthcare costs not covered by Original Medicare (Parts A and B). These policies are sold by private insurance companies and can significantly reduce out-of-pocket expenses for Medicare beneficiaries.

What are Medicare Supplements?

- Medicare Supplements help pay for costs like deductibles, copayments, and coinsurance that aren’t covered by Original Medicare. They do not cover prescription drugs, for which Medicare Part D is required.

Types of Medicare Supplement Plans

- There are several Medigap plans, each denoted by a letter (e.g., Plan A, Plan B, Plan C, etc.). Each plan offers a different level of coverage, but all plans of the same letter offer the same basic benefits regardless of the insurance company or location.

Enrollment in Medicare Supplements

- The best time to enroll in a Medigap policy is during the Medigap Open Enrollment Period, which begins on the first day of the month you turn 65 and are enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning you can buy any Medigap policy sold in your state, regardless of health status.

Underwriting in Medicare Supplements

- Outside the open enrollment period, you may be subject to medical underwriting for a Medicare Supplement policy. This process involves examining your medical history and current health to determine your eligibility and premium rates.

Costs of Medicare Supplements

- The cost of Medigap policies varies based on the plan type, location, and insurance company. Factors like age, gender, and tobacco use can also affect premiums.

Conclusion

Medicare Supplements are an excellent way to manage healthcare costs not covered by Original Medicare. Understanding the different plans, the best time to enroll, underwriting processes, and costs can help you make an informed decision tailored to your healthcare needs.